By USDR

This year had brought many challenged to investors across the world, since events like UK Parliamentary election, French Presidential Election and the beginning of Brexit negotiations created huge uncertainty and lots of volatility. Trading online had also been a big challenge for retail traders, trading from their broker account from home, but all those events have past and this material will focus on the best performing liquid instruments of 2017 thus far.

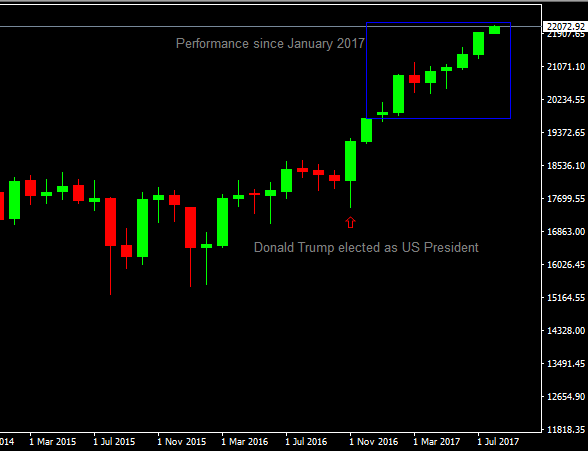

Dow Jones Industrial Average had been, by far, one of the best performing instruments this year. Starting to trade impulsively on the upside, after the election of Donald Trump as president, last year, Dow continued to improve this year, reaching the 22,000 milestone, up almost 3,000 point since January. Investors continue to be optimistic, since companies continue to report better than expected earnings and also, there are high expectancies from Donald Trump who promised at the beginning of his mandate a massive infrastructure program, fiscal and health reforms. Even though he managed to do very little thus far, market participants still believe that he will manage to keep the US economy on an ascending path. As long as private companies will continue to report solid gains, we expect the index to continue on its ascending path, even though from some experts’ point of view, the price is over extended.

EURUSD pair

The Quantitative Easing that ECB implemented a few years ago, begun to show some results, as the EU economy expanded above 1% figure. Also, rising inflation figures made investors to price in the possibility that the ECB will start to give up some of the unconventional measures adopted thus far. On the other hand, decreasing inflation in the US had reduced the prospects of further rate normalization by the Fed, thus adding pressure on the dollar.

Given the fact that the divergence now favors the euro, the pair surged from 1.0300 area and reached 1.1800 level this month, meaning almost a 15% gain just from the start of the year. Considering that the EURUSD is the most liquid forex pair, the gain is impressive, as the price variations are usually low.

There had been instruments that most likely had managed to perform better than the two above, but we tried to focus on liquid instruments, actively traded by retail and institutional investors. Low liquidity instruments can pose a greater risk as you could find it difficult to exit the market at a specific price. For those of you who want to trade a variety of instruments, trade.com is one of the options and you can find a trade.com review to figure out more about them.

Risk Warning and Disclaimer

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial instruments or services. Past performance is no indication or guarantee of future performance.