By CME Group, Special for USDR

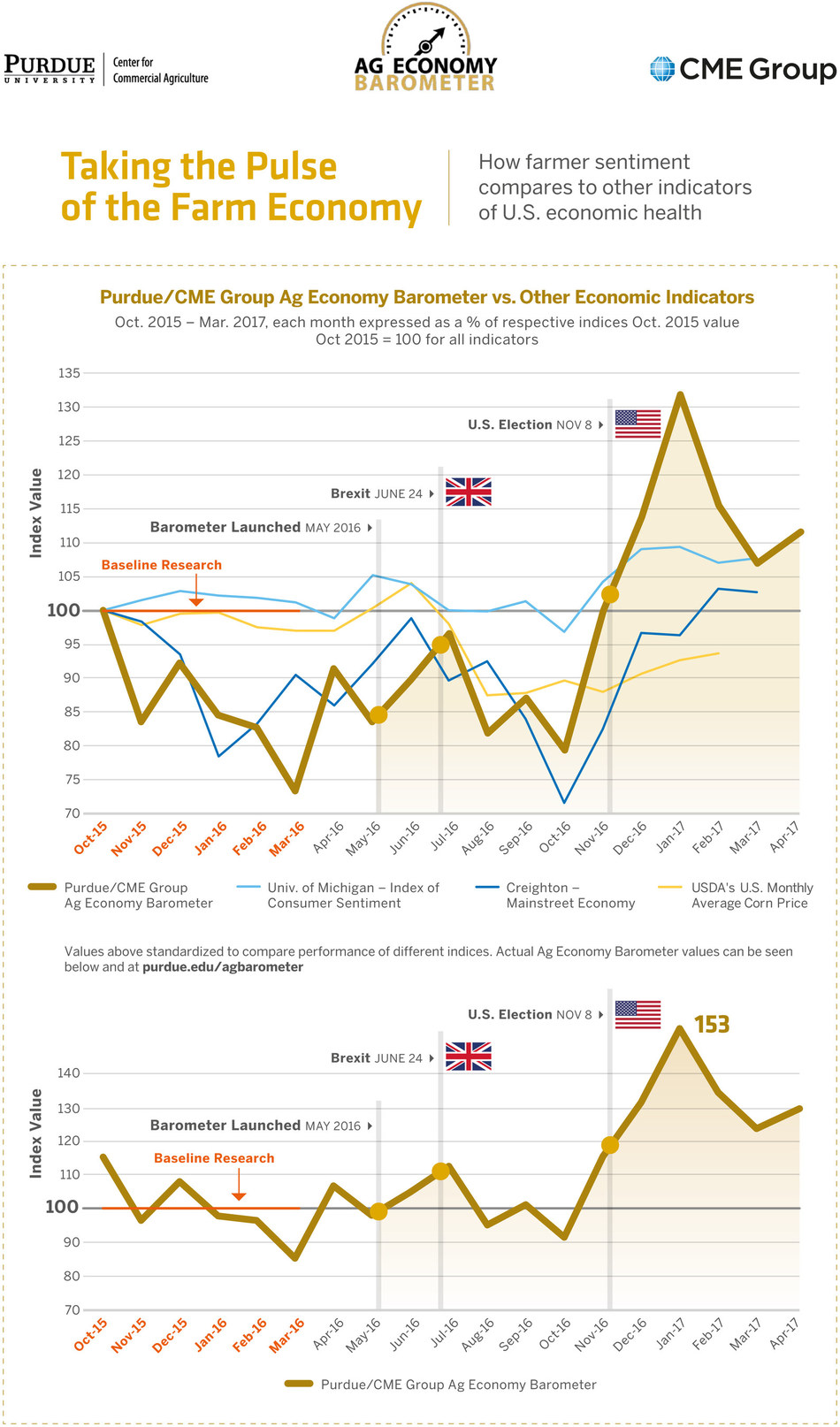

Producer sentiment toward the agricultural economy held steady in May, continuing a trend of overall higher optimism, according to the Purdue University/CME Group Ag Economy Barometer.

The May barometer read 130, the same as April. Producer sentiment has hovered around the 130-point mark for five of the last six months and remains much stronger than a year ago when it read 97. The barometer is based on a monthly survey of 400 agricultural producers from across the country.

While overall sentiment remained the same, there were some changes in the barometer’s sub-indices. The Index of Current Conditions fell to 117, a 10-point decline from its 127-point reading in April. In the Index of Future Expectations, however, producer optimism increased from 132 in April to 136 in May, marking the second-consecutive month of growth. Both reflect higher levels of producer optimism than at this time in 2016.

“Agricultural producers continue to be more optimistic about future economic conditions than they were before the November elections,” said Jim Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “There are multiple reasons behind producers’ optimism. For example, in previous surveys, just over 40 percent of respondents said they expected a more favorable regulatory environment for agriculture in the next five years than in the recent past.”

Trade also played a key role in increasing producer optimism, Mintert said.

In the May survey, a resounding 83 percent of producers reported that they are in favor of renegotiating the North American Fair Trade Agreement, or NAFTA. They expect a revised NAFTA to benefit the agricultural economy.

“Trade was a key source of debate during the 2016 elections and continues to be a priority for the current administration,” Mintert said. “In previous barometer surveys, 93 percent of respondents rated agricultural exports as important to the agricultural economy and 80 percent rated them as important for their own farms.”

The May survey also asked producers about their sentiments toward farmland values. Forty percent said they expect farmland values to be higher in five years than they are today. That is more than double the 19 percent of respondents expecting higher prices in 12 months.

Read the full May Ag Economy Barometer report at http://purdue.edu/agbarometer. This month’s report includes additional information on what’s driving the sub-indices, sentiment toward farmland values and NAFTA expectations.

The June barometer report will publish on Wednesday, July 5, due to the July 4 holiday.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

Note to journalists: The June Ag Economy Barometer Report will publish on Wednesday, July 5, due to the July 4 holiday.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) is where the world comes to manage risk. Through its exchanges, CME Group offers the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. CME Group provides electronic trading globally on its CME Globex platform. The company also offers clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives through its clearinghouses CME Clearing and CME Clearing Europe. CME Group’s products and services ensure that businesses around the world can effectively manage risk and achieve growth.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT, Chicago Board of Trade, KCBT and Kansas City Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. Dow Jones, Dow Jones Industrial Average, S&P 500 and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective o wners.

SOURCE CME Group