By National Association of Realtors, Special for USDR

After increasing to the highest annual rate in six months, existing-home sales tumbled in February amidst unshakably low supply levels and steadfast price growth in several sections of the country, according to the National Association of Realtors®. Led by the Northeast and Midwest, all four major regions experienced sales declines in February.

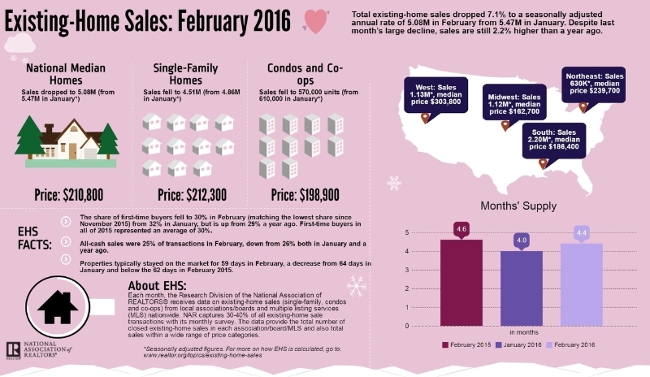

Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 7.1 percent to a seasonally adjusted annual rate of 5.08 million in February from 5.47 million in January. Despite last month’s large decline, sales are still 2.2 percent higher than a year ago.

Lawrence Yun, NAR chief economist, says existing sales disappointed in February and failed to keep pace with what had been a strong start to the year. “Sales took a considerable step back in most of the country last month, and especially in the Northeast and Midwest,” he said. “The lull in contract signings in January from the large East Coast blizzard, along with the slump in the stock market, may have played a role in February’s lack of closings. However, the main issue continues to be a supply and affordability problem. Finding the right property at an affordable price is burdening many potential buyers.”

According to Yun, job growth continues to hum along at a robust pace, but there appears to be some uneasiness among households that the economy is losing some steam. This was evident in NAR’s latest quarterly HOME survey – released earlier this month – which revealed that fewer respondents believe the economy is improving, and a smaller share of renters said that now is a good time to buy a home2.

“The overall demand for buying is still solid entering the busy spring season, but home prices and rents outpacing wages and anxiety about the health of the economy are holding back a segment of would-be buyers,” says Yun.

The median existing-home price3 for all housing types in February was $210,800, up 4.4 percent from February 2015($201,900). February’s price increase marks the 48th consecutive month of year-over-year gains.

Total housing inventory4 at the end of February increased 3.3 percent to 1.88 million existing homes available for sale, but is still 1.1 percent lower than a year ago (1.90 million). Unsold inventory is at a 4.4-month supply at the current sales pace, up from 4.0 months in January.

All-cash sales were 25 percent of transactions in February, down from 26 percent both in January and a year ago. Individual investors, who account for many cash sales, purchased 18 percent of homes in February (17 percent in January), matching the highest share since April 2014. Sixty-four percent of investors paid cash in February.

“Investor sales have trended surprisingly higher in recent months after falling to as low as 12 percent of sales in August 2015,” adds Yun. “Now that there are fewer distressed homes available, it appears there’s been a shift towards investors purchasing lower-priced homes and turning them into rentals. Already facing affordability issues, this competition at the entry-level market only adds to the roadblocks slowing first-time buyers.”

The share of first-time buyers fell to 30 percent in February (matching the lowest share since November 2015) from 32 percent in January, but is up from 29 percent a year ago. First-time buyers in all of 2015 represented an average of 30 percent.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage declined from 3.87 percent in January to 3.66 percent in February, which is the lowest since April 2015 at 3.67 percent. The average commitment rate for all of 2015 was 3.85 percent.

Properties typically stayed on the market for 59 days in February, a decrease from 64 days in January and below the 62 days inFebruary 2015. Short sales were on the market the longest at a median of 126 days in February, while foreclosures and non-distressed homes each took 57 days. Thirty-five percent of homes sold in February were on the market for less than a month.

NAR President Tom Salomone, broker-owner of Real Estate II Inc. in Coral Springs, Florida, says many Realtors® are saying instances of multiple bids and affordable homes going under contract quickly are common in their markets. “With low supply this spring buying season, it’s easy for buyers to get discouraged when their offer is rejected in favor of a higher bid,” he said. “That’s why it’s important for buyers to stay patient and work with a Realtor® to develop a negotiation strategy that ensures success without overstretching their budget.”

Matching the highest share since May 2015, distressed sales5 – foreclosures and short sales – rose slightly to 10 percent in February, up from 9 percent in January but down from 11 percent a year ago. Seven percent of February sales were foreclosures and 3 percent were short sales. Foreclosures sold for an average discount of 17 percent below market value in February (13 percent in January), while short sales were discounted 16 percent (12 percent in January).

Single-family and Condo/Co-op Sales

Single-family home sales fell 7.2 percent to a seasonally adjusted annual rate of 4.51 million in February from 4.86 million in January, but are still 2.0 percent higher than the 4.42 million pace a year ago. The median existing single-family home price was$212,300 in February, up 4.3 percent from February 2015.

Existing condominium and co-op sales decreased 6.6 percent to a seasonally adjusted annual rate of 570,000 units in February from 610,000 in January, but are still 3.6 percent above February 2015 (550,000 units). The median existing condo price was$198,900 in February, which is 5.1 percent above a year ago.

February existing-home sales in the Northeast descended 17.1 percent to an annual rate of 630,000, but are still 5.0 percent above a year ago. The median price in the Northeast was $239,700, which is 0.8 percent below February 2015.

In the Midwest, existing-home sales sank 13.8 percent to an annual rate of 1.12 million in February – unchanged from February 2015. The median price in the Midwest was $162,700, up 6.3 percent from a year ago.

Existing-home sales in the South decreased 1.8 percent to an annual rate of 2.20 million in February, but are still 3.3 percent above February 2015. The median price in the South was $186,400, up 5.0 percent from a year ago.

Existing-home sales in the West declined 3.4 percent to an annual rate of 1.13 million in February, but are still 0.9 percent higher than a year ago. The median price in the West was $308,800, which is 7.0 percent above February 2015.

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1.1 million members involved in all aspects of the residential and commercial real estate industries.

NOTE: For local information, please contact the local association of Realtors® for data from local multiple listing services. Local MLS data is the most accurate source of sales and price information in specific areas, although there may be differences in reporting methodology.

1Existing-home sales, which include single-family, townhomes, condominiums and co-ops, are based on transaction closings from Multiple Listing Services. Changes in sales trends outside of MLSs are not captured in the monthly series. NAR rebenchmarks home sales periodically using other sources to assess overall home sales trends, including sales not reported by MLSs.

Existing-home sales, based on closings, differ from the U.S. Census Bureau’s series on new single-family home sales, which are based on contracts or the acceptance of a deposit. Because of these differences, it is not uncommon for each series to move in different directions in the same month. In addition, existing-home sales, which account for more than 90 percent of total home sales, are based on a much larger data sample – about 40 percent of multiple listing service data each month – and typically are not subject to large prior-month revisions.

The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. Seasonally adjusted annual rates are used in reporting monthly data to factor out seasonal variations in resale activity. For example, home sales volume is normally higher in the summer than in the winter, primarily because of differences in the weather and family buying patterns. However, seasonal factors cannot compensate for abnormal weather patterns.

Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began. Prior to this period, single-family homes accounted for more than nine out of 10 purchases. Historic comparisons for total home sales prior to 1999 are based on monthly single-family sales, combined with the corresponding quarterly sales rate for condos.

2NAR’s 2016 first quarter HOME survey found that less than half of all respondents believe the economy is improving (48 percent), down from 50 percent in the December 2015 survey. Additionally, compared to the December 2015 survey fewer renters (62 percent versus 68 percent last quarter) believe that now is a good time to buy a home.

3The median price is where half sold for more and half sold for less; medians are more typical of market conditions than average prices, which are skewed higher by a relatively small share of upper-end transactions. The only valid comparisons for median prices are with the same period a year earlier due to seasonality in buying patterns. Month-to-month comparisons do not compensate for seasonal changes, especially for the timing of family buying patterns. Changes in the composition of sales can distort median price data. Year-ago median and mean prices sometimes are revised in an automated process if additional data is received.

The national median condo/co-op price often is higher than the median single-family home price because condos are concentrated in higher-cost housing markets. However, in a given area, single-family homes typically sell for more than condos as seen in NAR’s quarterly metro area price reports.

4Total inventory and month’s supply data are available back through 1999, while single-family inventory and month’s supply are available back to 1982 (prior to 1999, single-family sales accounted for more than 90 percent of transactions and condos were measured only on a quarterly basis).

5Distressed sales (foreclosures and short sales), days on market, first-time buyers, all-cash transactions and investors are from a monthly survey for the NAR’s Realtors® Confidence Index, posted at Realtor.org.

NOTE: NAR’s Pending Home Sales Index for February will be released April 27, and Existing-Home Sales for March will be released April 20; release times are 10:00 a.m. ET.

Information about NAR is available at www.realtor.org. This and other news releases are posted in the “News, Blogs and Videos” tab on the website. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

SOURCE National Association of Realtors