By USDR

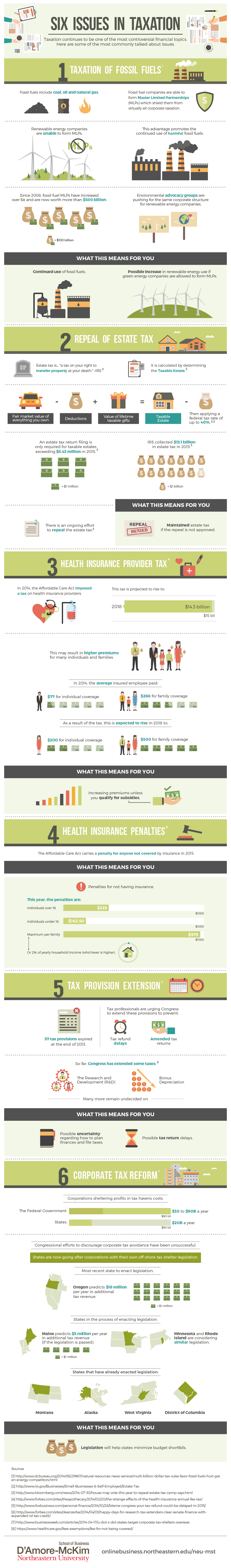

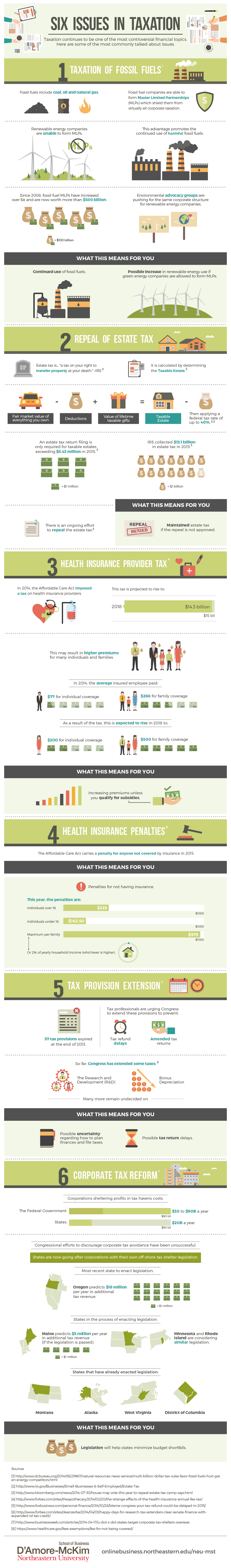

We often rely on tax professionals when it comes to filing our tax returns. The demand for tax consultants is higher than ever and universities such as Northeastern University are trying to cope with it at an equally staggering rate. Even with an experienced professional assisting you every step of the way, it is still necessary to take the time and understand some critical tax codes and tax issues. The health insurance provider tax is a good example and the perfect place to start.

When the Affordable Care Act was introduced, the law imposed a tax on health insurance providers. This tax is set to rise gradually until 2018. While this may be a minute issue at first glance, the impact of health insurance provider tax on your premium is actually quite significant.

If you’re paying $77 in healthcare insurance premium today, that premium will be a whopping $200 in 2018. For family coverage, the premium is forecasted to jump to $500 on the same year. You can learn more about the health insurance provider and other tax issues from the Six Issues in Taxation infographic.

The Six Issues in Taxation infographic was created by Northeastern University