By USDR

State tax policies have not kept pace with the rapidly changing Internet and service economy and lag behind new business models based on cloud computing, according to Bloomberg BNA’s exclusive annual Survey of State Tax Departments. As a result, corporate taxpayers are being taxed by more than one state for some transactions and other transactions are escaping taxation by any state, the survey finds.”It’s clear from the results of this year’s survey that states are still trying to catch up to the digital economy of the 21st century, at least as it relates to their tax codes,” said George Farrah, Executive Editor of Bloomberg BNA’s Tax & Specialty Division. “The situation creates a great deal of uncertainty for corporations if they can’t properly plan for the state tax impact of the cross-border services they provide.”

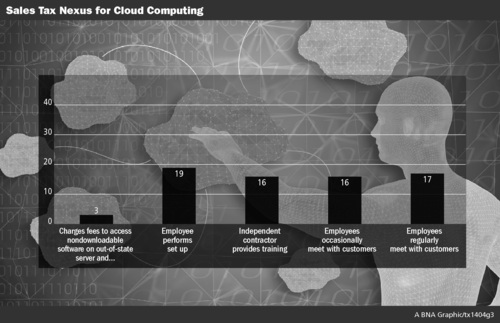

According to the survey, as the importance of geographical boundaries continues to diminish due to the Internet and cloud-based services, uncertainties appear to be multiplying for both states and businesses over basic issues, such as which states are allowed to impose their corporate income tax on intangibles, sales of services, or cloud-based transactions. The lack of uniformity in this area raises the likelihood that taxpayers will face unexpected results. For example, it remains unclear in many states how cloud-based transactions are characterized and taxed even as the use of such services is growing in popularity.

“Policy makers realize that this uncertainty is an increasingly important issue,” continued Farrah, “and many believe that federal legislation is necessary to bring clarity to business taxpayers in this area.”

The report further notes that the proposed federal Marketplace Fairness Act (MFA) is likely to take center stage in 2014 among state and local tax practitioners, businesses engaged in remote sales, and consumers making online purchases. Another measure, the Business Activity Tax Simplification Act of 2013 (BATSA), would define what constitutes a business’s physical presence in a state for taxation purposes. It would also expand the protection provided to interstate commerce to apply to sales of intangible property and services.

The Bloomberg BNA Survey of State Tax Departments, now in its 14th year, is aimed at clarifying each state’s position on the gray areas with regard to corporate income tax and sales and use taxes. The Bloomberg BNA Survey of State Tax Departmentshas been a reliable source of state tax information for practitioners and has been cited in congressional testimony.

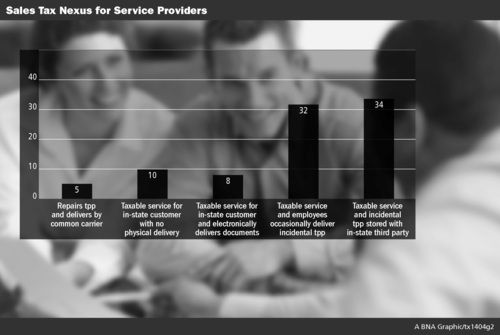

This year’s survey includes new portions addressing sales tax nexus for cloud computing and services. It also includes new portions regarding the rules for sourcing sales factor receipts for corporate income tax purposes. To compile the data, a questionnaire was sent to senior state tax officials in every state, the District of Columbia, and New York City. This year, every state participated in the survey, although some states declined to answer certain questions. The states were asked to provide their positions as of Dec. 31, 2013.

“We sincerely appreciate the participation we received from each and every state tax department,” said Farrah. “The amount of time the officials spent answering difficult questions is a testament to their professionalism and commitment to informing the tax community.”

A full copy of the report can be obtained at www.bna.com/state-tax-survey-2014.

About Bloomberg BNA

Bloomberg BNA, a wholly owned subsidiary of Bloomberg, is a leading source of legal, regulatory, and business information for professionals. Its network of more than 2,500 reporters, correspondents, and leading practitioners delivers expert analysis, news, practice tools, and guidance – the information that matters most to professionals. Bloomberg BNA’s authoritative coverage spans the full range of legal practice areas, including tax & accounting, labor & employment, intellectual property, banking & securities, employee benefits, health care, privacy & data security, human resources, and environment.

Average Rating